“`html

Ola Electric Mobility Ltd is a pioneering company in the electric vehicle (EV) sector in India, primarily focusing on electric scooters. Launched as a wave of innovation under the umbrella of the Ola Group—a leader in India’s ride-hailing space—Ola Electric aims to transform the transportation landscape by promoting sustainable and eco-friendly mobility solutions. Their products stand out for advanced technology integration, extended battery life, and affordability. As of 25 October 2024, the Ola Electric share price on the National Stock Exchange (NSE) is 77.29 INR. This article delves into an in-depth analysis of the share price targets for Ola Electric from 2024 to 2030, providing insights into market trends, competitive landscape, and factors influencing its future value.

Understanding Ola Electric Mobility Ltd: Market Overview

- Open Price: ₹80.05

- High Price: ₹80.49

- Low Price: ₹76.73

- Previous Close: ₹80.00

- Volume: 22,420,692

- Value (Lacs): ₹17,328.95

- VWAP: ₹77.77

- UC Limit: ₹96.00

- LC Limit: ₹64.00

- 52 Week High: ₹157.40

- 52 Week Low: ₹76.00

- Mkt Cap: ₹34,091 Cr

- Face Value: ₹10

Ola Electric Mobility Ltd’s Competitive Landscape

Ola Electric operates in a rapidly growing electric vehicle market, facing competition from various established and emerging players. Here’s a closer look at five significant competitors in the Indian EV sector:

- Ather Energy: Approximately $1 billion market cap. This startup is renowned for its high-performance electric scooters and is backed by notable investors like Hero MotoCorp.

- Hero Electric: A subsidiary of Hero MotoCorp, which holds a market cap of around ₹64,000 crore ($8 billion). Hero Electric is recognized as one of India’s prominent manufacturers of electric two-wheelers.

- TVS Motor Company: Valued at approximately ₹60,000 crore ($7.5 billion). TVS is actively enhancing its electric mobility solutions with the iQube e-scooter, marking its competitive presence in the EV sector.

- Bajaj Auto Ltd: With a market cap around ₹1.25 lakh crore ($15 billion), Bajaj Auto is venturing into the electric vehicle space with their Chetak electric scooter.

- Revolt Motors: Owned by RattanIndia Enterprises, roughly valued at ₹5,500 crore ($700 million), Revolt is known for its innovative electric motorcycles, focusing heavily on sustainable transportation.

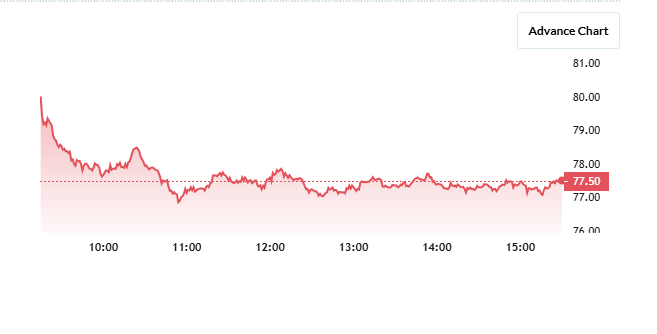

Current Trends: Ola Electric Share Price Chart

The share price trends reflect market dynamics along with consumer behaviors and competition, offering valuable insights for potential investors.

Ola Electric Share Price Targets from 2024 to 2030

| Ola Electric Share Price Target Years | Share Price Target |

| 2024 | ₹160 |

| 2025 | ₹200 |

| 2026 | ₹240 |

| 2027 | ₹280 |

| 2028 | ₹320 |

| 2029 | ₹360 |

| 2030 | ₹400 |

Ola Electric Share Price Target 2024: Factors Driving Growth

The anticipated share price target for Ola Electric in 2024 is ₹160. Here are three influential factors that may affect Ola Electric’s growth trajectory:

- Expansion of Charging Infrastructure: An extensive charging network is pivotal for the widespread acceptance of electric scooters. Ola Electric’s commitment to increasing its charging stations nationwide can enhance consumer confidence and drive sales.

- Supportive Government Policies: Favorable government initiatives aimed at promoting electric mobility, such as subsidies and incentives under FAME II, can significantly boost Ola Electric’s market penetration and share performance.

-

Technological Advancements: Continuous investment in research and development to enhance vehicle features, such as advanced battery technology and AI integration, may place Ola ahead of its competitors, improving brand loyalty and sales.

Ola Electric Share Price Target 2025: Headwinds Ahead

For 2025, the expected share price target for Ola Electric is ₹200. Consider these significant risks that may surface:

- Supply Chain Challenges: Increased demand for electric components could lead to potential shortages and extended lead times, affecting production rates and profit margins.

- Heightened Competition: With numerous firms entering the EV landscape, gaining market share may become challenging as competitors enhance their offerings and leverage aggressive pricing strategies.

-

Policy Changes: Variability in government policies targeting EV incentives and regulations could place additional cost burdens on operations, potentially impacting demand and profitability.

Ola Electric Share Price Target 2030: Long-Term Considerations

Looking forward to 2030, Ola Electric’s share price target is projected at ₹400. Here are potential challenges that could arise over this period:

- Battery Technology Innovation: The EV market is fast-evolving, meaning continual advancements in battery technology are crucial. Failure to adapt could jeopardize Ola Electric’s competitiveness.

- Increased Global Competition: As international brands like Tesla intensify their focus on the Indian market, Ola Electric may face formidable competition that could hinder its growth prospects.

-

Stricter Environmental Regulations: Compliance with future environmental and sustainability standards could escalate operational costs, impacting long-term profitability and share performance.

FOR MORE INFORMATION, VISIT THE OFFICIAL WEBSITE: https://www.olaelectric.com/

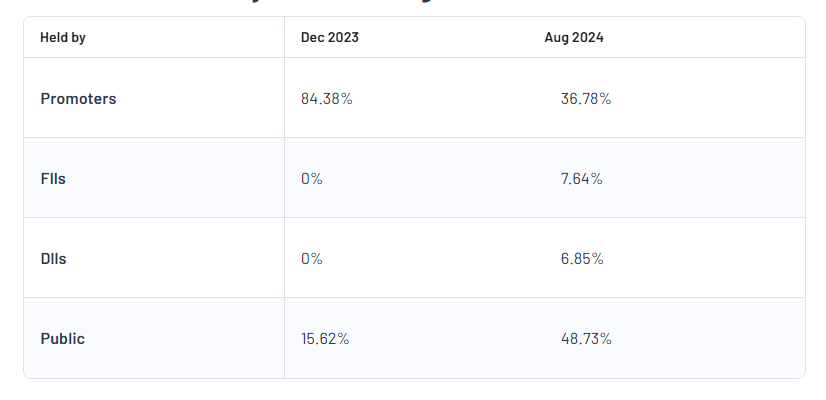

Ola Electric Mobility Ltd: Shareholding Pattern

- Promoters: 36.78%

- Foreign Institutional Investors (FII): 7.64%

- Domestic Institutional Investors (DII): 6.85%

- Public Shareholding: 48.73%